Ensure a stable future for The Research Foundation and help generations to come by including us in your estate plans.

"I decided to include The Research Foundation in my estate plan for several reasons. As a faculty member at Research College of Nursing, I have seen countless students benefit from scholarships supporting their educational journey. Personally, I have benefited from the financial support provided to faculty in pursuit of doctoral education. The vision of The Research Foundation – to partner for a healthy community – resonates with me as a nurse and member of the Kansas City community." -Julie Nauser, PhD, RN, CNE

Planned gifts offer many immediate and long-term benefits, like current income tax deductions, reduced estate taxes, and the satisfaction of making a significant and enduring contribution. A named gift can even serve as a permanent memorial to a loved one. Learn more about the different ways you can make planned gifts below.

BEQUESTS

A gift by will allows you to make a significant contribution that was not affordable during your lifetime. The simplest gift is a bequest in your will. Most bequests leave a specific amount or percentage of the donor’s estate to charity with no restrictions on how the money is to be used. Because the full value of the bequest is deductible, heirs generally escape gift and estate taxes.

ENDOWMENT FUNDS

Through contributions from our dedicated donors, we provide scholarships to nursing and allied health students in the Kansas City area and surrounding region. You can support health care education by making a gift of $25,000, given over time or all at once, to establish a named endowment fund. The interest earned is given as an annual scholarship in perpetuity. When establishing the fund, you can define the criteria for the annual scholarship award, such as financial need, academics, or service. View a list of current named scholarship funds donors have established here. Read stories about those who have established funds below.

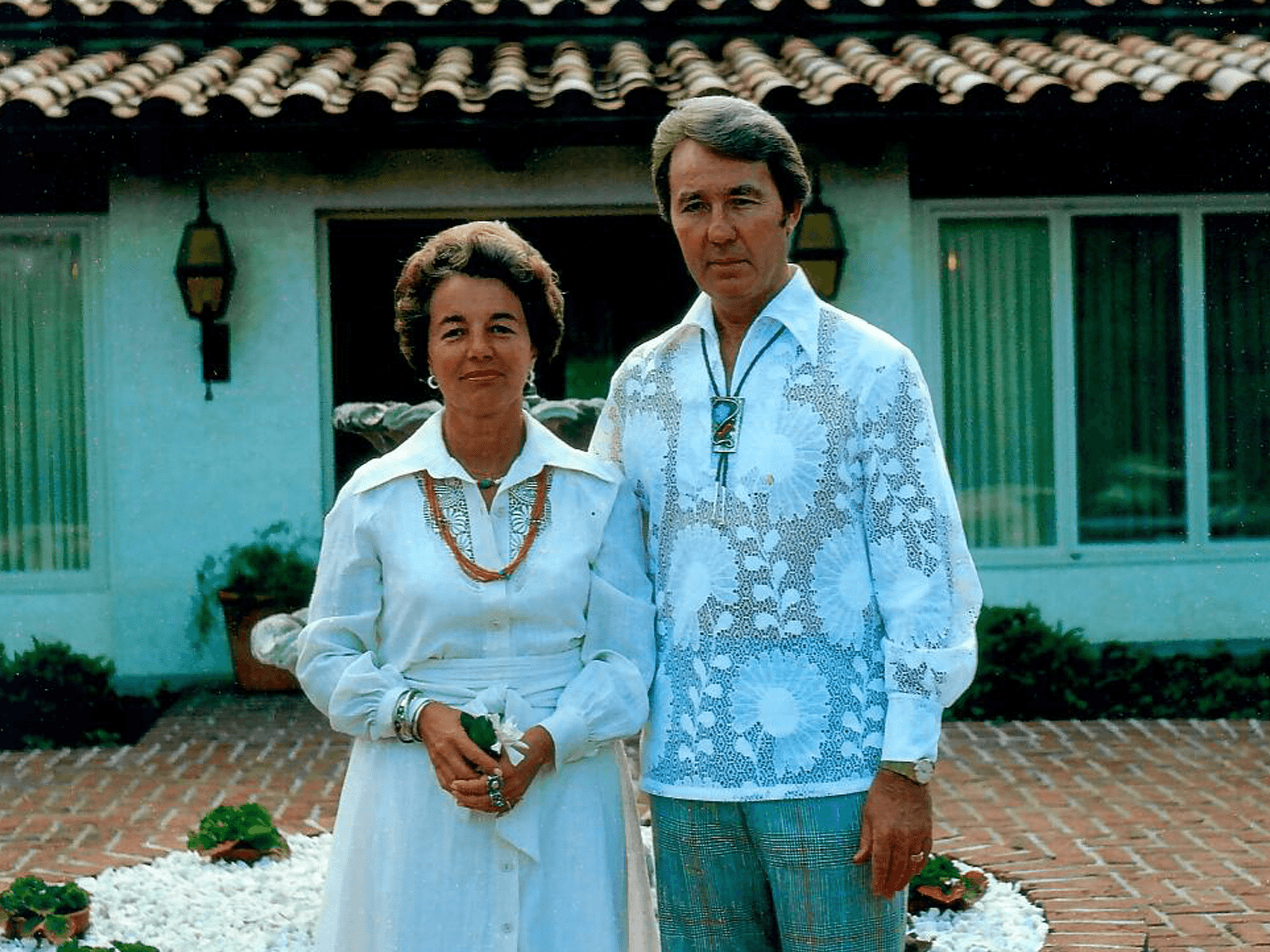

The Clarkson family’s connection to health care is personal. Bill and Janice have 11 children and 43 grandchildren. From pediatric checkups to emergency room visits, their family learned firsthand the value of accessible, high-quality medical care.

Judy started giving to The Research Foundation after graduation. Decades later, she established a scholarship fund to support future nurses.

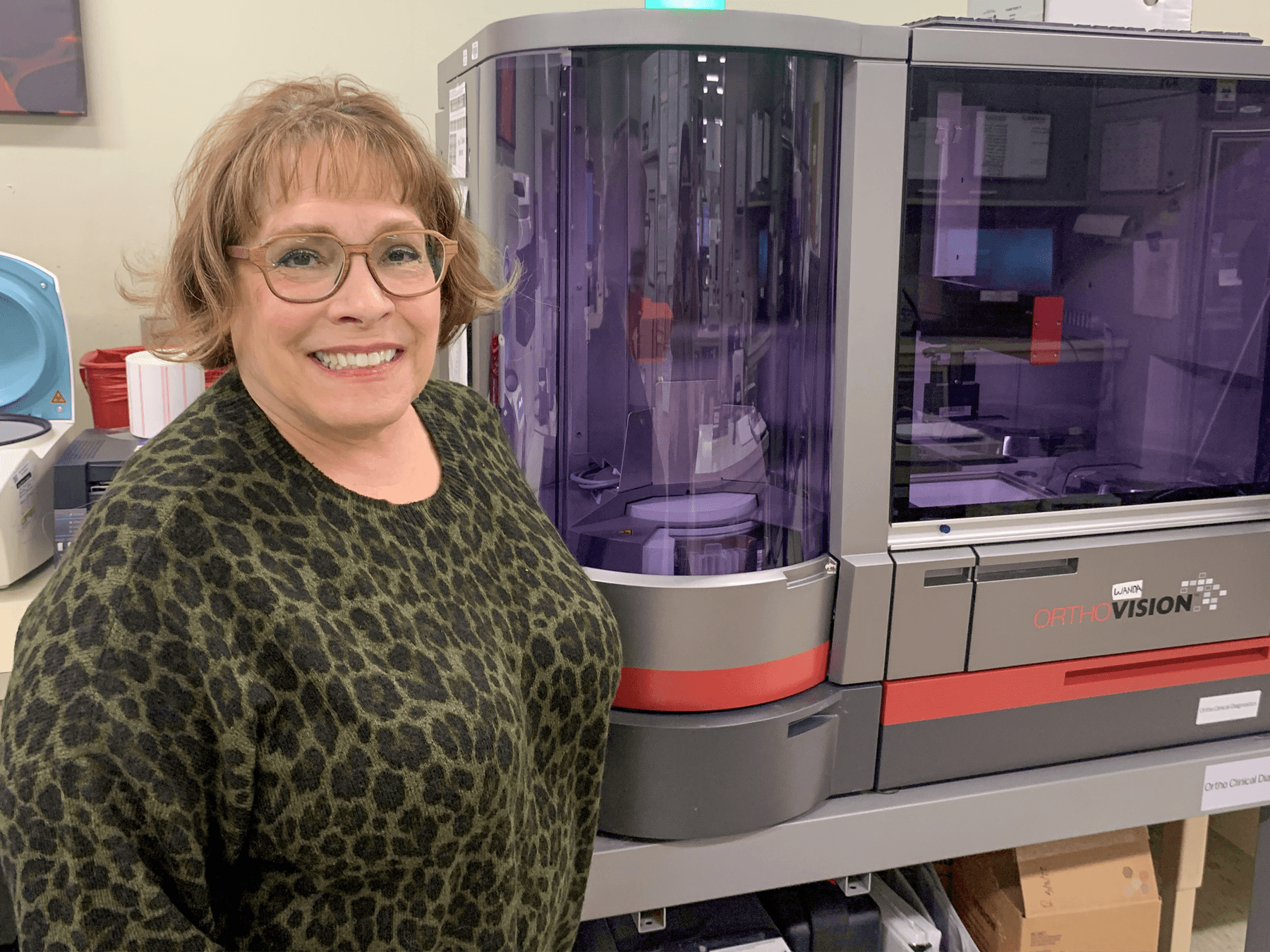

Lucia created a scholarship to attract laboratory students to Kansas City and encourage them to stay and work in our community.

OTHER GIFTS

- Stock: By making a gift of appreciated stock (held more than one year), you can avoid or delay the capital gains tax. You may deduct the current fair market value of the stock on your tax return no matter what was originally paid for the stock. Your broker will need to the following information: NFS LLC, DTC # 0226, For the Benefit of The Research Foundation, Account # 087-594210.

- Life Insurance: A new or existing life insurance policy can be assigned to The Research Foundation with premium payments made as annual gifts. The result is a major gift at an affordable cost.

- Real Estate and Personal Property: Property may be used to fund a planned giving vehicle, or may be given outright to The Research Foundation.

- Trusts: A Charitable Remainder Trust can provide lifetime income to you.

- Gift Annuities: By making an annuity gift now, you can receive a lifetime income for yourself, a spouse, or anyone else you designate in exchange for a gift of cash, stock, or securities to The Research Foundation. At the time of your death, the gift remainder will support us.

- IRA Charitable Rollover: The IRA Charitable Rollover is a unique giving strategy that allows donors aged 73 or older to make tax-free charitable contributions directly from their Individual Retirement Accounts (IRAs) to qualified nonprofit organizations, like The Research Foundation.